Further Hard Rock Gold Workings Discovered on Egyptian Projects

Altus Strategies Plc / Index (EPIC): AIM (ALS) TSX-V (ALTS) OTCQX (ALTUF) / Sector: Mining

09 November 2021

Altus Strategies Plc

(“Altus” or the “Company”)

Further Hard Rock Gold Workings Discovered on Egyptian Projects

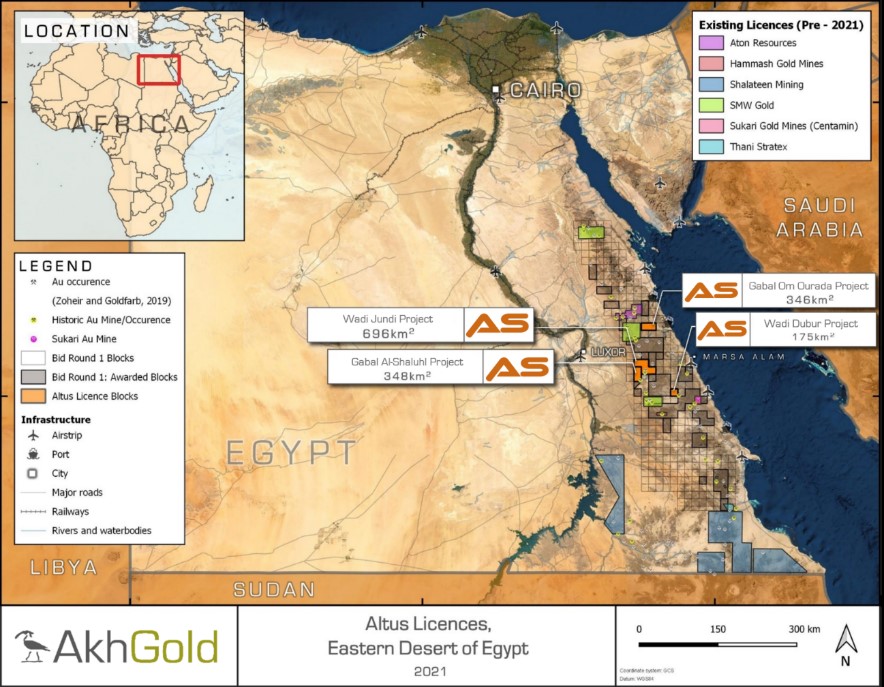

Altus Strategies Plc (AIM: ALS, TSX-V: ALTS, OTCQX: ALTUF) announces the discovery of further hard rock artisanal gold workings from field reconnaissance at the Company’s 100% owned Gabal Al-Shaluhl (348 km2) and Wadi Jundi (696 km2) projects, located in the Eastern Desert of Egypt. The Company’s 100% owned subsidiary, Akh Gold Ltd (“Akh Gold”), holds four gold exploration projects (“Projects”) totalling 1,565 km2 in Egypt. The Projects were granted this year as part of a competitive international bid round undertaken by the Egyptian Mineral Resources Authority (”EMRA”).

Highlights:

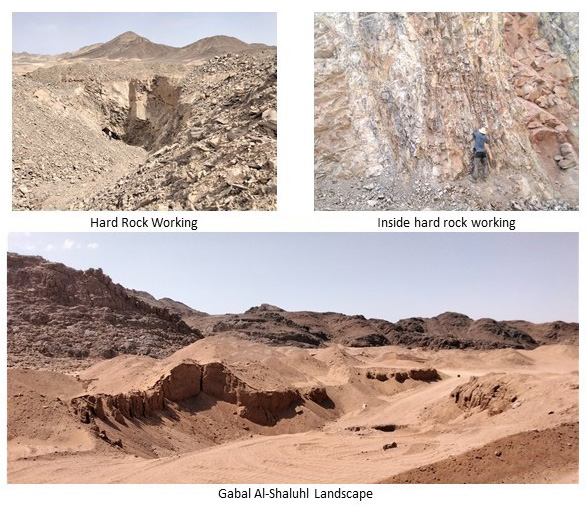

- Fourteen hard rock artisanal gold workings discovered across two Projects in Egypt

- Workings are up to 30m wide and 100m long with several mechanically excavated

- More than 50 hard rock gold workings now confirmed across the Projects to date

- At least 35 further remote sensing targets remaining to be assessed

- Discoveries validate the Company’s target generation process in Egypt

Steven Poulton, Chief Executive of Altus, commented:

“We are pleased to report that, following recent reconnaissance exploration by the Company’s Egyptian field team, 14 hard rock gold workings have been discovered at the Gabal Al-Shaluhl and Wadi Jundi projects, with an additional 35 targets still to be visited. These two projects comprise 1,044 km2 of our total landholding of 1,565 km2 in the highly prospective Eastern Desert of Egypt.

“Individual hard rock workings are up to 30m wide and 100m long and the presence of mechanised machinery at some of these suggests significant gold potential exists. In September, we announced the discovery of 37 hard rock workings across our Gabal om Ourada and Wadi Dubur gold projects. These recent discoveries increase the total number of hard rock gold workings discovered to date on our Projects in Egypt to 50.

“Our initial reconnaissance has underscored the significant prospectivity of the licence areas that Altus has selected and been awarded. We have recently established a high calibre technical and operational team in Egypt, which means we are in a strong position to aggressively advance exploration. I look forward to updating shareholders on the results of this work in due course.”

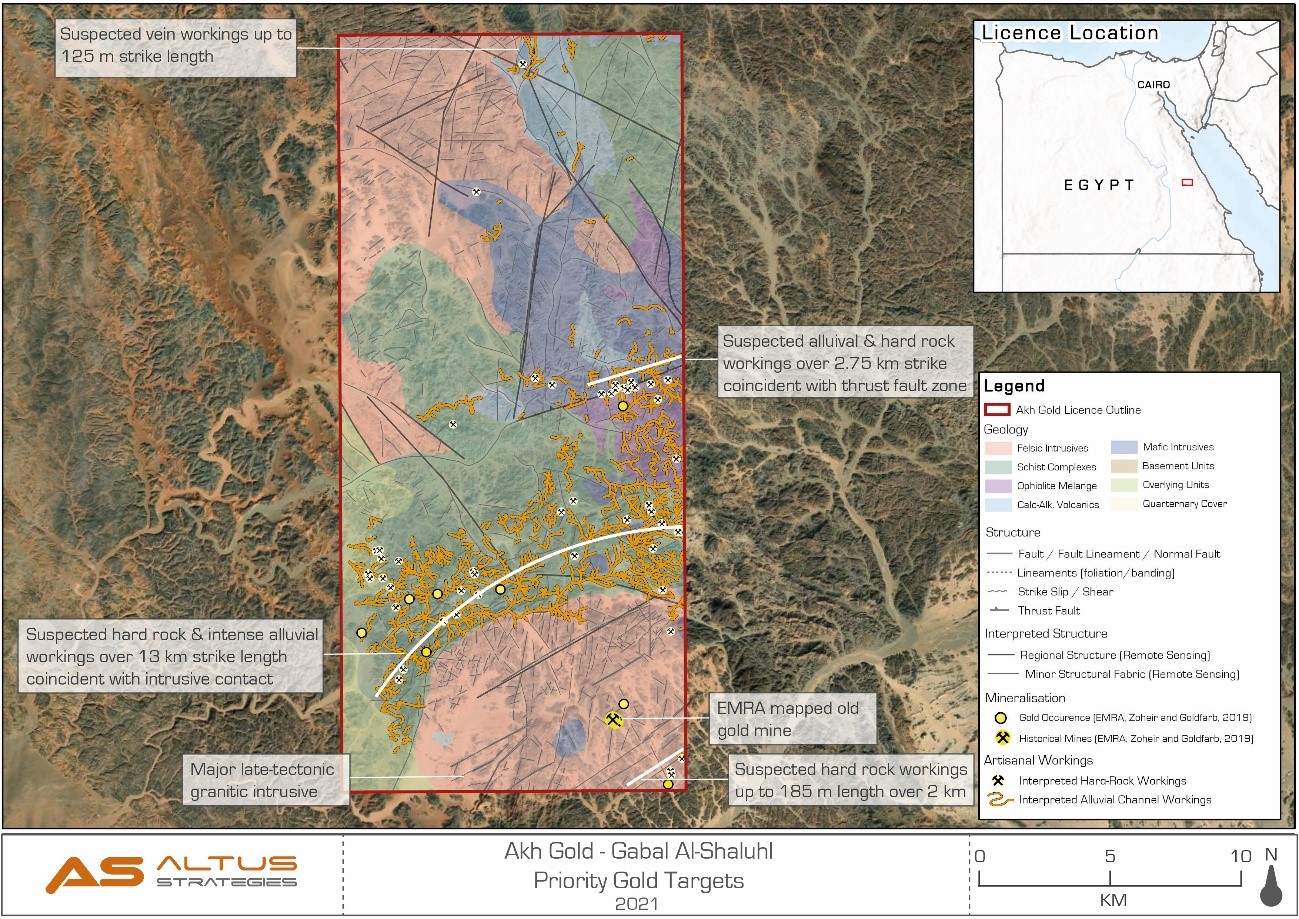

Hard Rock Workings: Gabal Al-Shaluhl Licence (348 km2)

- Three of 15 high priority targets (as defined by desktop studies) have been visited

- Numerous historical, artisanal hard rock workings (mechanised and smaller scale)

- Workings traced for up to 100m, associated with shear zones and around granite margins

- Quartz-vein style gold mineralisation (orogenic gold), both fault and intrusion hosted

- Hydrothermal alteration (silica, carbonate and iron oxide) and visible sulphide mineralisation observed

- Priority targets for follow-up work delineated with numerous other targets to be assessed

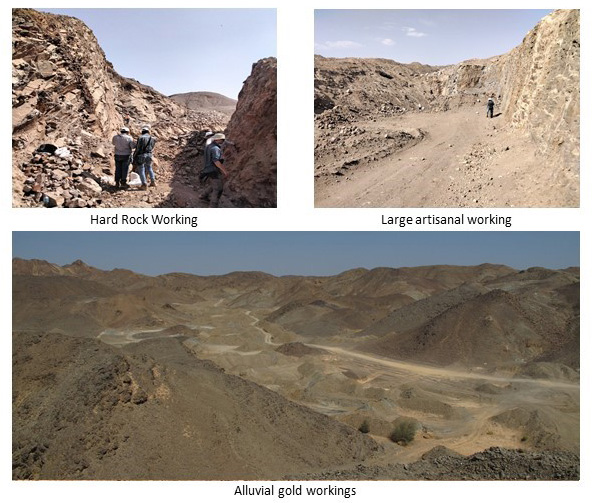

Hard Rock Workings: Wadi Jundi Licence (696 km2)

- Seven of 35 high priority targets (as defined by desktop studies) have been visited

- Numerous historical artisanal hard rock workings (mechanised and smaller scale)

- Workings targeting sheeted systems associated with granitoid intrusions

- Quartz-vein style gold mineralisation (orogenic gold), both fault and intrusion hosted

- Hydrothermal alteration with silica and clay alteration and sulphide (pyrite)

- Priority targets for follow-up work delineated with numerous other targets to be assessed

Next Phase of exploration

Systematic target evaluation and ranking will commence shortly at the Projects. Ground work will include reconnaissance mapping as well as detailed structural, alteration and mineralisation mapping, along with grab and channel sampling.

Projects: Background (1,565 km2)

The Projects were awarded to Akh Gold, as part of Egypt’s inaugural competitive international exploration licence bid round, initiated by EMRA in 2020. All four Projects, which together comprise nine licence blocks covering 1,565 km2, are situated in eastern Egypt, between 30 km and 100 km from the Red Sea coast. The Projects have been awarded for an initial two-year term, with each Project renewable for up to two further periods, each of two years duration.

Illustrations

The following figures have been prepared by Altus and relate to the disclosures in this announcement. They are visible in the version of this announcement on the Company's website (www.altus-strategies.com).

- Location of the Projects in the Eastern Desert of Egypt is shown in Figure 1

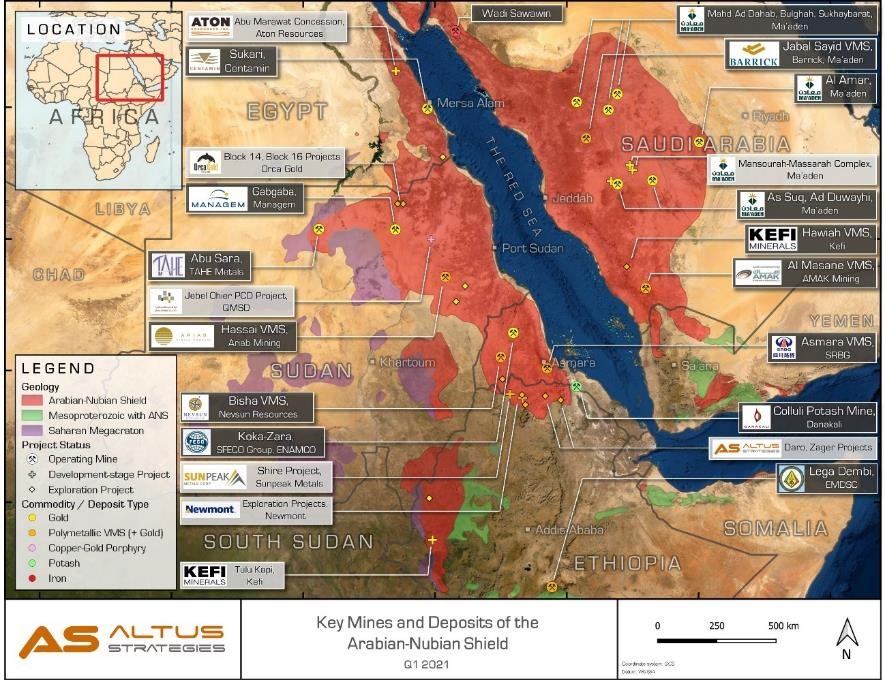

- Location of key deposits within the Arabian Nubian Shield is shown in Figure 2

- Location of priority targets within Gabal Al-Shaluhl is shown in Figure 3

- A selection of photos of gold workings at Gabal Al-Shaluhl is shown in Figure 4

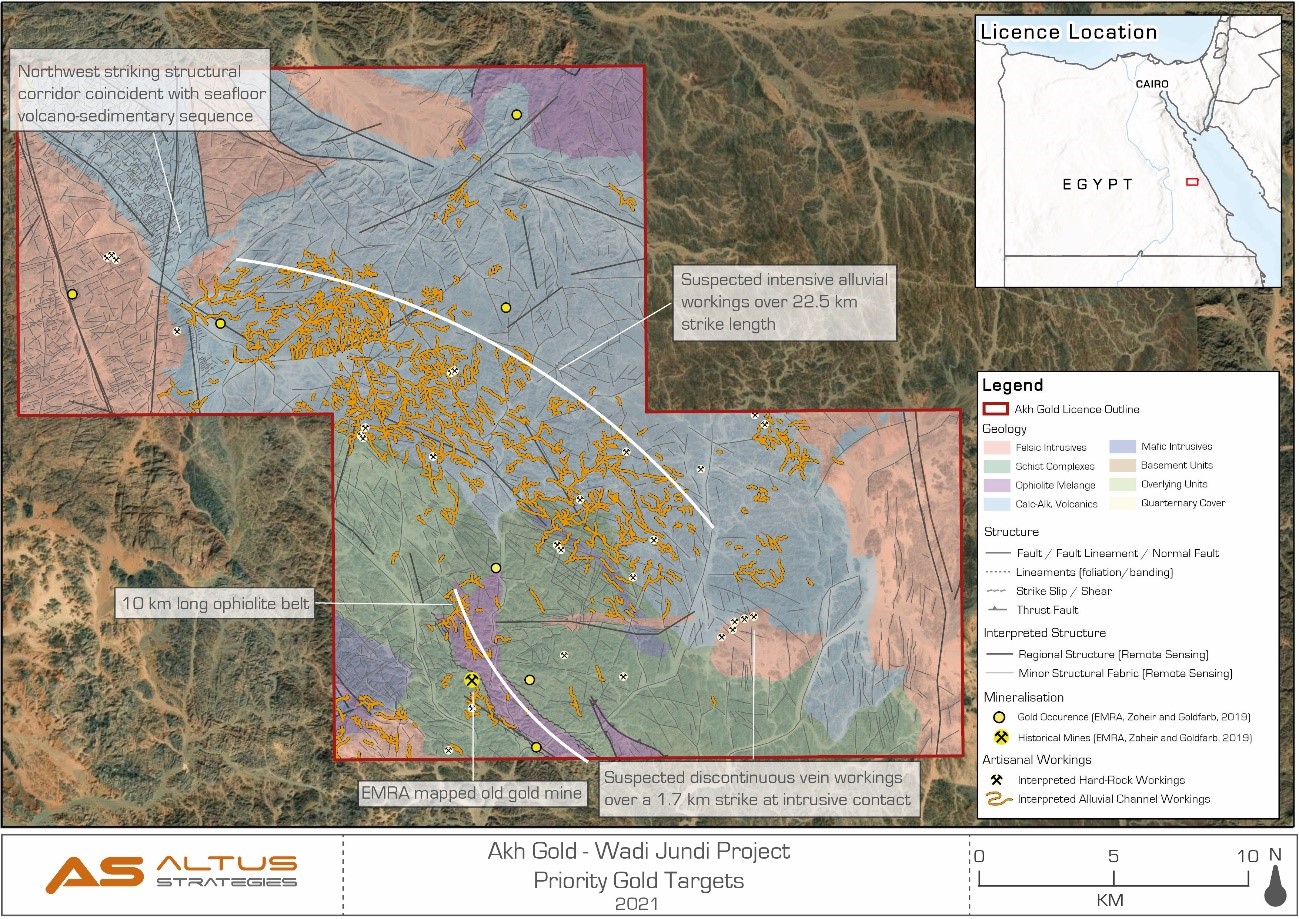

- Location of priority targets within Wadi Jundi is shown in Figure 5

- A selection of photos of gold workings at Wadi Jundi is shown in Figure 6

Figure 1: Location of the Projects in the Eastern Desert of Egypt

Figure 2: Location of key deposits within the Arabian Nubian Shield

Figure 3: Location of priority targets within Gabal Al-Shaluhl (348 km2)

Figure 4: A selection of photos of gold workings at Gabal Al-Shaluhl

Figure 5: Location of priority targets within Wadi Jundi (696 km2)

Figure 6: A selection of photos from gold workings at Wadi Jundi

Project Overview: Wadi Jundi (696 km2)

The Wadi Jundi Project consists of four licence blocks, covering a total area of 696 km2. The Project area hosts a 10 km long, north-west trending ophiolite belt comprising a basal serpentinite melange overlain by calc-alkaline basic to acidic volcanics, capped by volcaniclastics, and sediments (schists). The sequence is interpreted to represent a preserved seafloor sequence and is considered highly prospective for volcanogenic massive sulphide (“VMS”) mineralisation. The entire sequence is intruded by syn- to late-tectonic mafic intrusives and late- to post- tectonic granodiorite, granite and monzogranite intrusions and is located just south of the major north-west trending regional crustal scale >1,100 km Najd Fault corridor. Altus believes Wadi Jundi is prospective for orogenic gold mineralisation related to deformed volcanic sequences proximal to granite intrusions, as well as VMS deposits.

The Project is located approximately 40 km south of the historic El Sid gold mine, which reportedly contributed around 45% of Egypt's gold production during the 20th century, and is 115 km north-west of the Sukari gold mine, which produces approximately 400,000 ounces of gold per year. Mineralisation hosted at El Sid and Sukari is not necessarily indicative of mineralisation hosted at the Wadi Jundi Project. Wadi Jundi is directly accessible by secondary tracks from the Al Kosair-Qena asphalt highway, which runs along the Project’s northern boundary and connects the city of Luxor and coastal town of Quseer.

Project Overview: Gabal Al-Shaluhl (formerly Bakriyah) (348 km2)

The Gabal Al-Shaluhl Project consists of two licence blocks, covering a total area of 348 km2. The Project area is dominated sedimentary formations and a 13 km long northwest striking ophiolitic serpentinite melange, intruded by syn- to late-tectonic gabbro intrusives and major late- to post-tectonic granodiorite and granite intrusions. The geology is structurally complex, located near the boundary between two separate structural blocks with a large number of intersections between regional-trending faults and fold hinges, interpreted as favourable sites for orogenic gold style mineral occurrences. Altus believes Gabal Al-Shaluhl is prospective for orogenic gold mineralisation related to granite intrusions.

The Project is located approximately 60 km south of the historic El Sid gold mine, and 115 km north-west of the Sukari gold mine. Mineralisation hosted at El Sid and Sukari is not necessarily indicative of mineralisation hosted at the Gabal Al-Shaluhl Project. Gabal Al-Shaluhl is accessible by secondary tracks from a major E-W asphalt road 30 km to the south, which connects to the Red Sea coastal town of Marsa Alam.

Project Overview: Gabal Om Ourada (formerly Abu Diwan) (346 km2)

The Gabal Om Ourada Project consists of two licence blocks, covering a total area of 346 km2. The Project area hosts a north-west trending belt of serpentinised ophiolite and associated tectonic melange, schists, andesite and porhyryitic subvolcanic rocks, intruded by multiple syn- to late-tectonic granodiorite and late- to post-tectonic granite intrusions. Basement gneisses and mylonitic schists of the Meatiq Dome, a metamorphic core complex, outcrop in the south-west of the area and are separated from the younger rocks by a series of deep-seated north-west trending sinistral shear zones and north-east trending thrusts that are part of the crustal scale (>1,100 km long) Najd Fault Corridor. Altus believes Gabal Om Ourada is prospective for orogenic gold mineralisation hosted in an ophiolite belt proximal to a granite intrusion.

The Project is located approximately 30 km north-east of the historic El Sid gold mine, and 160 km north-west of the Sukari gold mine. Mineralisation hosted at El Sid and Sukari is not necessarily indicative of mineralisation hosted at the Gabal Om Ourada. Gabal Om Ourada is directly accessible by asphalt road from the Red Sea coastal city of El Quseir, located 30 km to the south-east.

Project Overview: Wadi Dubur (175 km2)

The Wadi Dubur Project consists of one licence block, covering a total area of 175 km2. The Project area contains a north-west to west trending curvilinear fault belt comprised of regionally mapped thrust faults and strike-slip flexures. The (standalone) Project block consists of an ophiolite melange, minor schists, syn- to late-tectonic gabbro and diorite intrusives on the flank of a major 25 km x 28 km syn- to late-tectonic granitic body. Altus believes Wadi Dubur is prospective for orogenic gold mineralisation hosted in a north-west trending ophiolite belt.

The Project is located 5 km west of the historic Atud gold mine and approximately 40 km north-west of the Sukari gold mine (operated by LSE and TSX listed Centamin Plc). Mineralisation hosted at Atud and Sukari is not necessarily indicative of mineralisation hosted at the Wadi Dubar Project. Wadi Dubur is directly accessible by asphalt road from the Red Sea coastal town of Marsa Alam, 60 km to the east.

Qualified Person

The technical disclosure in this regulatory announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master's degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

| Altus Strategies Plc

Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767

E-mail: info@altus-strategies.com |

| SP Angel (Nominated Adviser)

Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

| SP Angel (Broker)

Grant Barker / Richard Parlons |

Tel: +44 (0) 20 3470 0471 |

| Shard Capital (Broker)

Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

| Yellow Jersey PR (Financial PR & IR)

Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512

E-mail: altus@yellowjerseypr.com |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is a mining royalty company generating a diversified and precious metal focused portfolio of assets. The Company’s differentiated approach of generating royalties on its own discoveries in Africa and acquiring royalties globally through financings and acquisitions with third parties, has attracted key institutional investor backing. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law and regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organisation of Canada accepts responsibility for the adequacy or accuracy of this release.

Market Abuse Regulation Disclosure

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

Glossary of Terms

The following is a glossary of technical terms:

“EMRA” means the Egyptian Mineral Resources Authority

“km” means kilometres

“m” means metres

“NI 43-01” means National Instrument 43-101 Standards of Disclosure of Mineral Projects of the Canadian Securities Administrators

“Qualified Person” means a person that has the education, skills and professional credentials to act as a qualified person under NI 43-101

“VMS” means Volcanogenic Massive Sulphide